Generating passive income through stocks

- Kris Jenkins

- Mar 31, 2023

- 4 min read

Disclaimer: this blog post contains general information. This is NOT personal financial advice and should not be acted upon. Please speak to your financial advisor or accountant about your specific situation before making any investment decision. This article was originally written in August 2022, so charts are from that period.

Owning residential property can produce passive income to the owner in terms of rental income, but did you know the same can be said of Stocks?

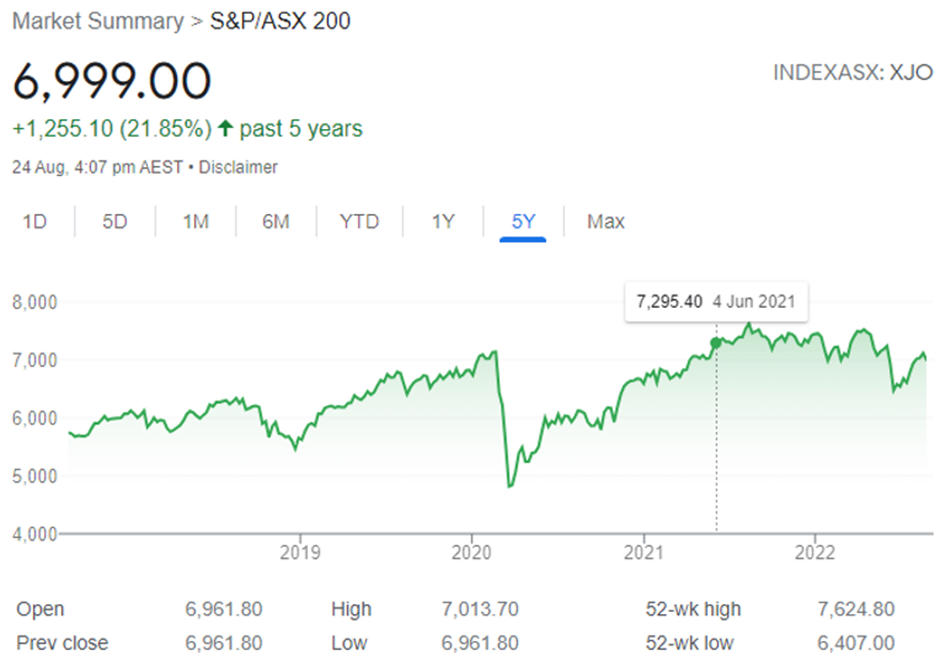

When I talk to people about investing in the Stock (or Share) market, they often associate that with the concept of Capital Gains and envision something like an index chart (like the one shown below). They think that when the stock market is down, they are losing and when it's going up, they're winning. But those assumptions are quite wide of the mark, if you ask me!

I like to challenge people with the idea that Stocks are no different to Property (okay... maybe a little different but hear me out), in the sense that both have the ability to create a Capital Gain (the value moving up) and both have the ability to provide a passive income to the owner - one does it in the form of rent, the other in the form of dividends.

Now, I know many people believe the Dividend payouts of Stocks is quite low and that the yield on rental property is much better - it is somewhat situational to the stock and property you compare, but when invested in the same proportions, you CAN achieve a passive income from Stocks that would be comparable to, if not be higher than Property (Again, dependent on what you are comparing).

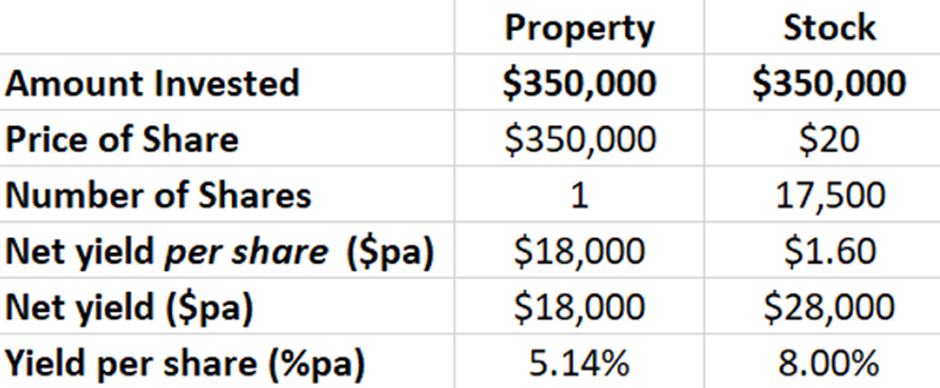

I was recently having a discussion with a gentleman about his rental property producing $700 per week ($3,033pm) in rent on a $350,000 (AUD) house. He was chuffed with the high rental yield. After taking into consideration the $1,100pm debt repayment, agent commissions of $152pm (5%), council rates ($2,000pa), expenses ($2,000pa), tax etc. his monthly income was estimated to be around $1,500 net, which sounds quite good, right? Factoring all of this in, the overall yield would roughly equate to the following: $1,500 x 12 = $18,000 per annum / $350,000. That's an estimated net yield of around 5.14% per annum.

What a lot of people don't realise is that there are plenty of companies listed on the ASX (Australia) boasting dividend yields still up around 8-10% per annum even in falling markets.

Further to that, there are Exchange Traded Funds (ETF's) available on the ASX that specifically look for high yielding companies to invest in, that are yielding close to 10% per annum NET. I personally invest in some ETF's that provided a franked distribution (dividend) of 17% last financial year - while the capital value of the stock has plunged, I only focus on the income - you'll see why soon.

What most people believe is that because the dividend per share is shown as a tiny number, in the single digit dollars or even cents, that the overall yield is low. That may not be the case and you may be missing a fantastic opportunity! Several things have to be considered here:

- What is the price of the stock?

- How much do you have invested?

- What is the dividend per share for that stock?

For example (and YES I am going to make shares look good here on purpose)... if a Stock is trading at $20.00 per share and the final fully franked dividend (net) is $1.60 per share, your yield would be 8%. If you took the $350,000 of the price of the investment property above and instead invested it into the Stock at $20 per share, you would own 17,500 shares in the company. At $1.60 dividend per share you would earn $28,000 in dividend payments, that is $10,000 per annum more than property! As shown below:

This is a VERY simplified example, rent/dividends change over time, expenses and tax will also change the overall net yields. And again, I've purposely shown an example to make stocks look better - not to make property appear worse - more so to highlight that information can be interpreted differently depending on how you look at it.

In essence, I wanted to show you that a stock with a dividend of $1.60 per share could still produce a higher income than that of an investment property, if invested in the right proportions - which most people would not usually consider.

Of course, the price of the stock would move up and down as time goes on, as does the value of property, but the number of units invested in would not reduce just because the stock market has gone down - a key takeaway to remember. I see the stock market dropping, as an opportunity to buy more units of the stock or ETF at a discount, not because I hope it goes up in value (which of course I would want), but because I want to own more units of the investment, as the additional units would provide me more in the way of dividends.

In the discussion I had with this gentleman, we looked at his share portfolio and he was shocked that despite the stock market being volatile, the dividend payment would still occur. He thought that you only made money on stocks when you sold and only if the value of the stocks were higher. Obviously, dividends will change each year, so it's good to do in depth research on what you're investing in - but the overall idea is that there is an opportunity to create a passive income from Stocks, not just property.

Now don't get me wrong here, I am NOT saying Stocks are better than property - not at all. I buy both asset classes as a part of my overall portfolio and believe diversification across different asset classes (Property and paper assets) is good. The example was simply to show that there is an opportunity to create a passive income from Stocks, not just property.

The idea is that the more income producing assets you can accumulate over time, regardless of what the capital value is doing, you will be one step closer to financial freedom as your passive income should continue to grow.

That's all for today folks, stay safe and continue growing!

.png)

Comments